Pay only for the time you need –

by the hour.

I am a fee-only, advice-only, fiduciary planner which means:

- I only work for you and in your best interests.

- I am proactive in disclosing any conflicts of interest that may impact you.

- I do not accept any compensation from the purchase or sale of financial products.

- I don’t charge any other hidden fees.

How complex is your financial life?

I work in three distinct ways:

- Hourly Financial Advising (billed in 6 minute increments) – $385

- Financial Insight Consultation (7 hours) – $2,695

- Comprehensive Financial Planning (based on complexity)

$3,850 – $7,700 – Level 1 Financial Plan (10-20 hours)

$4,620 – $9,625 – Level 2 Financial Plan (12-25 hours)

$5,775 – $11,550 – Level 3 Financial Plan (15-30 hours)

$9,625 – $15,400 – Level 4 Financial Plan (25-40 hours)

$15,400+ – Level 5 Comprehensive Planning (40+ hours)

$385 – hourly rate

To get a firm quote and to see if we would be a good fit, contact me for a no-obligation introductory meeting.

Why do people hire me?

Validation

I offer clients an independent validation of their financial decisions.

“Am I on the right track?”

Ideation

I offer clients new ideas and strategies they may not have thought of on their own.

“Are there things I should be doing differently?”

Trusted Thought Partner

I am a trusted resource for you.

“Who will be my thought partner in the future when my situation or external circumstances change?”

Family Resource

I am a resource to your spouse and children.

“Who will I turn to if something happens to my spouse?”

“Who can help prepare my children to manage their finances well?”

No asset management or subscription fees.

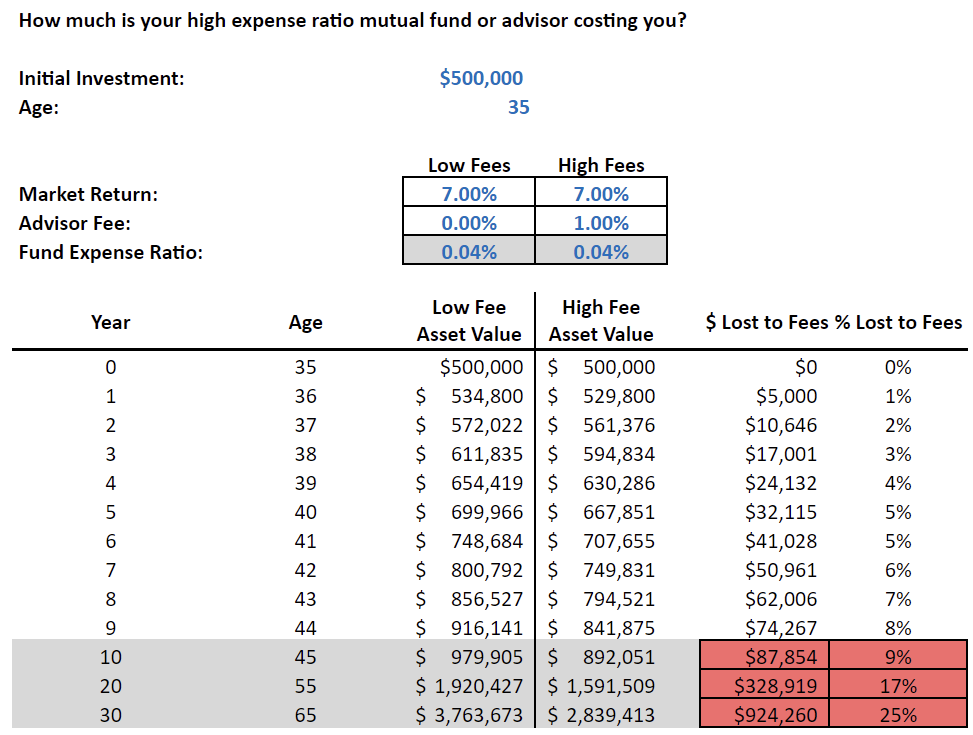

When I say hourly financial planning, I mean hourly. Period. Most fee-only firms collect asset management fees (typically 1% of your assets per year, or $20k per year for a $2M portfolio) as their primary form of compensation for advice.

I chose to be different. The hourly model means you get access to the same high level of service and expert financial advice whether you have a net worth of $1,000 or $100 million.

See the impact of “assets under management” (AUM) fees on your lifetime investment returns, and how much you have to gain by going hourly.

What are the costs after the initial financial planning process is complete?

Once we have completed the plan, future reviews are often a fraction of the initial cost. Have a five-minute question, you pay for five minutes. Need to discuss employment benefits for one hour, and your bill will be for one hour. No hidden fees or commissions means that you can be confident that you are only paying for solid financial advice.

Review a detailed list of areas of advice included in each level.